7 Keys to Growing Your Business with Mid-Market Companies

Small & Mid-Sized Businesses (SMBs) are the fastest-growing segment of the economy. Almost 97% of SMBs or SMEs (small and medium enterprises) in the United States are privately-owned. Private ownership means it’s more challenging to access company or management information. So how do you find accurate intelligence and insights on companies and decision-makers when the market is so opaque?

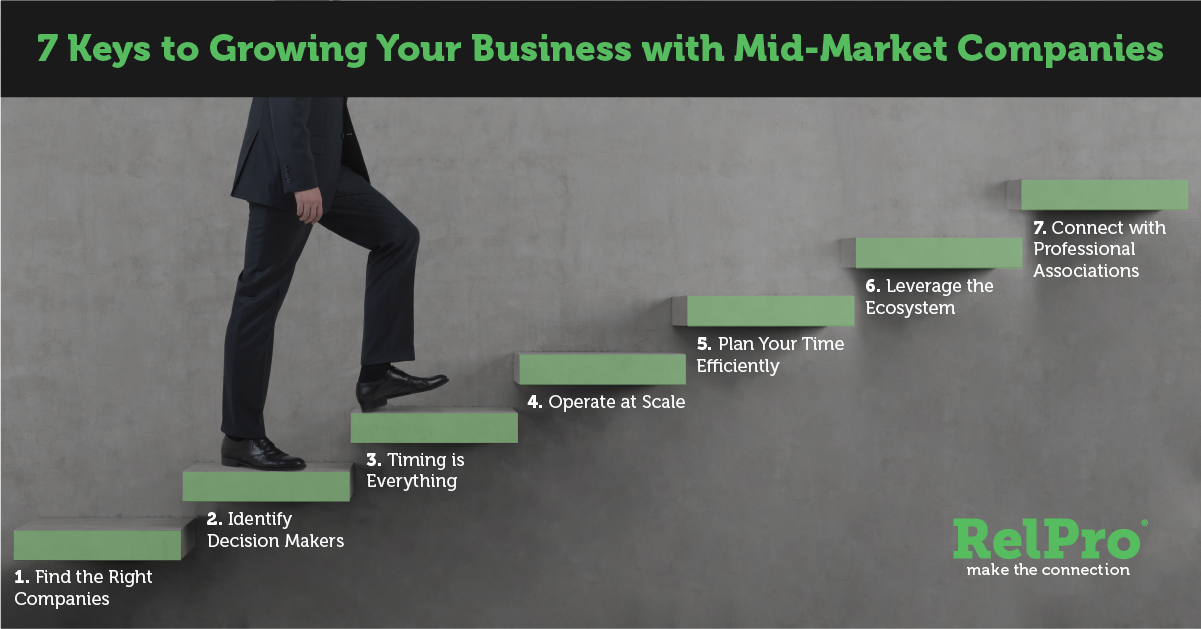

RelPro’s clients include national leaders in Financial Services and Professional Services targeting the Middle Market, so we know a thing or two about how to target Mid-Market companies effectively and efficiently. Here are some of the best practices we’ve seen.

With hundreds of thousands (even millions) of companies in the Middle Market, the biggest initial challenge is finding reliable sources of company data to search. Manually combing through state directories, local business listings, and trade references on new businesses is a slow and painful method of screening for potential leads. It’s not systematic, and it wastes your precious time. Even if you have a digital source of company data, filtering companies by revenue, number of employees or geographic location can yield unexpected or misleading results. For example, revenue data may be outdated (from the previous year’s tax return) and address information may refer to a company branch location, not their Headquarters. Unless all companies have been coded with all firmographic filters, the application of more filters will lead to companies being “missed” from your search results.

Beyond the pitfalls of basic firmographic data, the typical industry classifications also provide a very incomplete picture of the SME market. SIC and NAICS codes are often too generic, preventing granular industry targeting and not reflecting new sectors of the economy, like cloud computing and cybersecurity. You need to harness the power of Artificial Intelligence and Machine-Learning to automate the gathering of industry keywords directly from company websites - enabling you to find companies based on how the companies are actually describing themselves.

Depending on the industry you are in, there is often specialist company data sources that need to be factored into the perfect company search. For example, providers of international cross-border services may use import-export and bills of lading volumes to target fast-growing companies, while financing companies may use UCC filings, Fundraising announcements or Aircraft lease data to identify companies with upcoming (or recent) funding needs.

The truth is, there’s no single source of truth in SMB business development, which is why RelPro partners with the highest quality data providers to deliver unparalleled coverage and quality of insights on more than seven million companies enriched with industry keywords, revenue & geographic data, and specialist data used by business development professionals in Commercial Banking, Wealth Management and Private Equity. The integration of both data and workflow saves you time and helps you work smarter with comprehensive company screening tools, leading to efficient campaign and territory planning, and time savings when you are on the road and need to find companies to call at short notice.

2. Identify Decision Makers with ACCURATE Contact DetailsFirst the good news - unlike large corporations, in SMBs there may be just one or two people who have financial decision-making authority. Now the bad news - while the CEO or CFO’s name may be readily available from the company website, their contact details are a closely-guarded secret - they are busy people - and they often don’t have executive assistants answering their phones and booking appointments for you to see them! Plus, in the SME space, management turnover can be higher. To identify and connect with targeted decision-makers requires accurate and timely data and, as with company data, there is no one single “nirvana” data source. That’s why RelPro integrates multiple best-in-class sources of SMB decision-maker data, and that’s how RelPro delivers 95% coverage of CEO, President, Owner and CFO roles at Mid-Market companies. You will never again need to say “I want to speak that company but I don’t know how to reach them.”

3. Timing is EverythingSometimes, purchase decisions are made more quickly in SMBs. And sometimes, it feels like they are postponed indefinitely. Although your meeting may have gone well, and the CFO wanted the product, the funding may not be available to invest right then. Understanding your customer’s purchasing process is important, for sure, but having a mechanism to trigger a conversation when something has happened (or when there’s an opportune time to speak) is critical to keep you on the pulse of your prospect (or client). With RelPro Alerts, you might learn that the company has recently landed a new deal, or that the CEO is speaking at an upcoming trade show, or has been recognized for some achievement in their community. A quick note or call to congratulate them can trigger new, or reopen existing, discussions. Your consistent and informed outreach reinforces your credibility, shows that you care, strengthens your relationship, and helps close the contract!

4. Operate at ScaleIn the Middle Market, success breeds success - if you find your product or service resonates with one type of customer, or a group of “perfect customers”, the fastest way to grow your business is to find more companies like them - that’s not rocket science! RelPro’s customizable “Saved Search” and “Favorite Role” filters help you lock-in parameters to quickly repeat your perfect customer searches for different territories or market segments. If you want to get a broader view of market sizing and segmentation for budgeting, planning and resource allocation then consider a Total Addressable Market assessment using the RelPro platform yourself or using RelPro’s experienced Data Services team.

5. Plan & Manage Your Time EfficientlyIf you are planning a road trip or going to a conference, optimizing your time out of the office is essential. You want to speak with as many quality prospects as possible, but in the opaque SMB market, without an effective screening tool, it is impossible to use your time productively. While planning that sales trip to St. Louis, did you miss a large account because you didn’t realize they were in the area? The ability to geo-code companies from relevant source data will ensure that significant opportunities to meet prospects are not missed. Likewise, you may speak with 25-30 people at a dinner event, but did you capture the attention of the executive managing the biggest account in the room? Pre-planning your trips with smart intelligence allows you to focus on the most productive prospects and clients.

6. Leverage the EcosystemAnother essential characteristic of the Mid-Market space is that 84% of SMBs use referrals and professional networks to make their purchases - the SMB crowd value and favor collaboration. These practices encourage SMB executives to rely on information and advice from trusted colleagues. It saves them time. The relationships you build with clients and other sales partners can be a powerful source of new leads within their industry network. Also, by affiliating yourself with other industry influencers – lawyers and accountants for example – and referring people to them you will build your profile with these Centers of Influence and raise the likelihood of receiving qualified leads yourself.

7. Connect with Key Trade Associations, Conferences, and EventsAnother important dimension of the SME network is the many notable trade shows and Professional Associations that bring people together. They include the U.S. Chamber of Commerce Small Business Summit, the INC 5000 Conference and events organized by theAssociation for Corporate Growth (ACG) across the country. These events are fertile territory for finding major prospects. The more you tap into these watering-holes of influence to build your network, the wider your referral net to attract new leads and potential clients.

In summary, success in SMB Business Development starts with quality company and firmographic data that enables you to slice and dice this market to find and quality companies to call on. Look for accurate contact details and quality relationship insights on senior executives. Use informed outreach, based on triggers and alerts, to stay in touch with prospects and keep you on their pulse – their timing will often not be the same as yours. Seek out tools which integrate data and workflow to save your time identifying and qualifying targets. Manage and plan your time on the road and at events to capture the best opportunities. Most importantly, use relationship intelligence & management skills to build and strengthen your network of SMB influencers and referrals. It’s ALL about relationships in the end!

To learn more about RelPro sales intelligence, please reach out to our Customer Success team by email at support@relpro.com or by phone at (888) 561-7890.

RelPro’s Sales Intelligence Platform was built with the knowing that there is no one nirvana source of B2B Company and Decision-Maker data – so why rely on one source of data? RelPro integrates data from best-in-class partners and the web to provide you with a unique Global database of over 7 Million Companies & 150 Million Business Decision-Makers allowing you to easily identify the best prospects and close deals faster. RelPro includes automated Prospect Research to quickly inform your outreach, and powerful Alerts that provide a call-to-action prompting timely outreach to prospects and clients. To learn more about RelPro, visit our website – www.relpro.com, give us a call – (888) 561 7890 or send us an email – info@relpro.com, or sign up for a demo. To learn what our customers are saying about RelPro, read the reviews on G2 Crowd.